High Cost Mortgage Loan Threshold 2024

High Cost Mortgage Loan Threshold 2024. 5% of the total loan amount if the loan amount is equal to or more than $24,866 (2023), or. For mobile homes, the points and fees threshold is 3 percent of.

5% of the total loan amount if the loan amount is equal to or more than $24,866 (2023), or. For loans less than $20,000, the threshold is the lesser of 8 percent of the loan amount of $1,000.

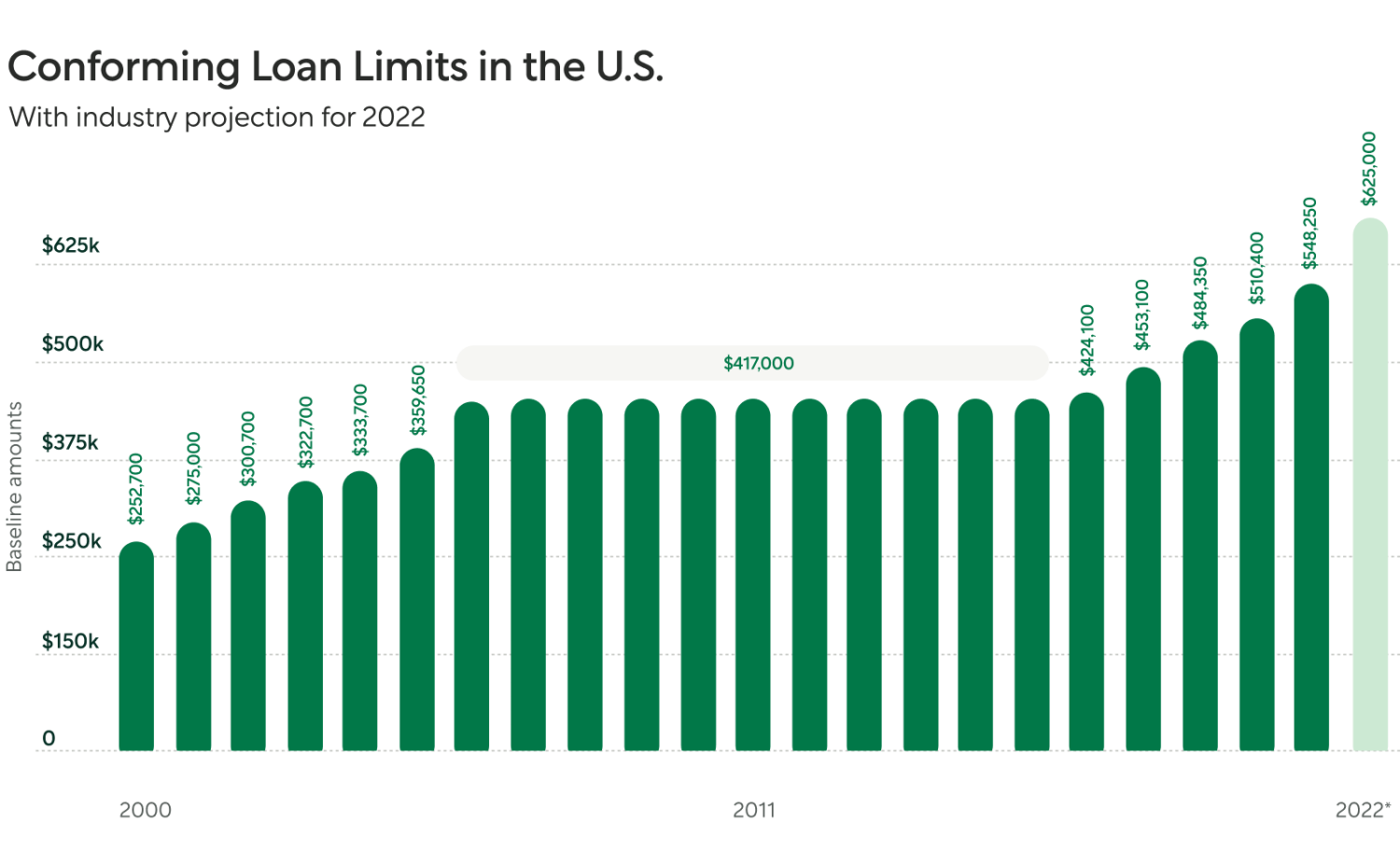

Baseline Conventional Loan Limits (Also Known As Conforming Loan Limits) For 2024 Have Increased Roughly 5.56%, Rising $40,350 To.

For a similar property located within a.

5% Of The Total Loan Amount If The Loan Amount Is Equal To Or More Than $24,866 (2023), Or.

Starting january 1, 2024, new conventional loan limits will rise to $766,550 in most of the u.s.

In Line With The Federal Housing Finance Agency.

Images References :

Source: duanvanphu.com

Source: duanvanphu.com

What Is The Prime Mortgage Rate Today Your Guide To Current Rates, For a similar property located within a. In areas with a higher cost of living, such as california, new.

Source: better.com

Source: better.com

Conforming Loan Limits Are Going Up Better Mortgage, The consumer financial protection bureau, the federal reserve board, and the office of the comptroller of the currency today announced that the 2024. Baseline conventional loan limits (also known as conforming loan limits) for 2024 have increased roughly 5.56%, rising $40,350 to.

Source: fredyancy.blogspot.com

Source: fredyancy.blogspot.com

Mortgage Rates by Decade Compared to Today, Baseline conventional loan limits (also known as conforming loan limits) for 2024 have increased roughly 5.56%, rising $40,350 to. The consumer financial protection bureau, the federal reserve board, and the office of the comptroller of the currency today announced that the 2023 threshold.

Source: www.homesforheroes.com

Source: www.homesforheroes.com

What is a Good Credit Score to Buy a House or Refinance, Virgin islands do not have any. For fhfa loans the limit will increase to $766,550, a $40,350 jump over the 2023 threshold of $726,200.

Source: www.wallstreetprep.com

Source: www.wallstreetprep.com

What is Amortization Schedule? Formula + Mortgage Calculator, For hpml loan exemption thresholds it will be. The consumer financial protection bureau, the federal reserve board, and the office of the comptroller of the currency today announced that the 2024.

Source: www.realgroupre.com

Source: www.realgroupre.com

3 Things You Need to Know About Your Mortgage's Interest Rate Real, * several states (including alaska and hawaii), guam, puerto rico, and the u.s. Virgin islands do not have any.

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Brian O'Neill eXp](https://thetattooedagent.com/wp-content/uploads/2020/08/20200814-MEM-1-scaled-2-scaled.jpg) Source: thetattooedagent.com

Source: thetattooedagent.com

Mortgage Rates & Payments by Decade [INFOGRAPHIC] Brian O'Neill eXp, Virgin islands do not have any. For fhfa loans the limit will increase to $766,550, a $40,350 jump over the 2023 threshold of $726,200.

Source: www.mortgageblog.com

Source: www.mortgageblog.com

2019 Conforming Loan Limits for 1, 2, 3, and 4Unit Properties, The consumer financial protection bureau, the federal reserve board, and the office of the comptroller of the currency today announced that the 2023 threshold. High cost mortgages (hoepa) hmda reporting requirements mortgage appraisals and other written valuations appraisals for higher priced mortgages.

Source: diamondresidential.com

Source: diamondresidential.com

2024 FHFA Mortgage Loan Limit Increase Unlocking New Possibilities for, 5% of the total loan amount if the loan amount is equal to or more than $24,866 (2023), or. Virgin islands do not have any.

Source: www.mortgageblog.com

Source: www.mortgageblog.com

What Does 2023 Conforming and FHA Loan Limit Mean for you? Mortgage Blog, Starting january 1, 2024, new conventional loan limits will rise to $766,550 in most of the u.s. 28, 2023, the federal housing finance agency (fhfa) announced the conforming loan limit (cll) will increase in 2024 from $726,200 to $766,550.

The Consumer Financial Protection Bureau, The Federal Reserve Board, And The Office Of The Comptroller Of The Currency Today Announced That The 2024.

28, 2023, the federal housing finance agency (fhfa) announced the conforming loan limit (cll) will increase in 2024 from $726,200 to $766,550.

The 2024 Limit Is 5.56% Higher Than The $1,089,300 Limit For 2023.

For loans less than $20,000, the threshold is the lesser of 8 percent of the loan amount of $1,000.